Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7 were covered in The Adjustment Process. The process of using of the income summary account is shown in the diagram below. Prepare the closing entries for Frasker Corp. using the adjustedtrial balance provided. Notice what forms a good business team that the Income Summary account is now zero and is readyfor use in the next period. The Retained Earnings account balanceis currently a credit of $4,665. Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings.

Close all dividend or withdrawal accounts

Although the drawings account is not an income statement account, it is still classified as a temporary account and needs a closing journal entry to zero the balance for the next accounting period. The first entrycloses revenue accounts to the Income Summary account. The secondentry closes expense accounts to the Income Summary account. These permanent accounts form the foundation of your business’s balance sheet. However, you might wonder, where are the revenue, expense, and dividend accounts?

Step 2: Close Expense accounts

Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry. Take note that closing entries are prepared only for temporary accounts. Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships (dividends for corporations).

Would you prefer to work with a financial professional remotely or in-person?

RetainedEarnings is the only account that appears in the closing entriesthat does not close. You should recall from your previous materialthat retained earnings are the earnings retained by the companyover time—not cash flow but earnings. Now that we have closed thetemporary accounts, let’s review what the post-closing ledger(T-accounts) looks like for Printing Plus. Temporary (nominal) accounts are accounts thatare closed at the end of each accounting period, and include incomestatement, dividends, and income summary accounts.

By leveraging automated systems, businesses can ensure that all tasks related to closing entries are handled seamlessly, reducing manual effort and minimizing errors. Once we have obtained the opening trial balance, the next step is to identify errors if any, make adjusting entries, and generate an adjusted trial balance. Below are the T accounts with the journal entries already posted. We’ll use a company called MacroAuto that creates and installs specialized exhaust systems for race cars.

- The third entry requires Income Summary to close to the Retained Earnings account.

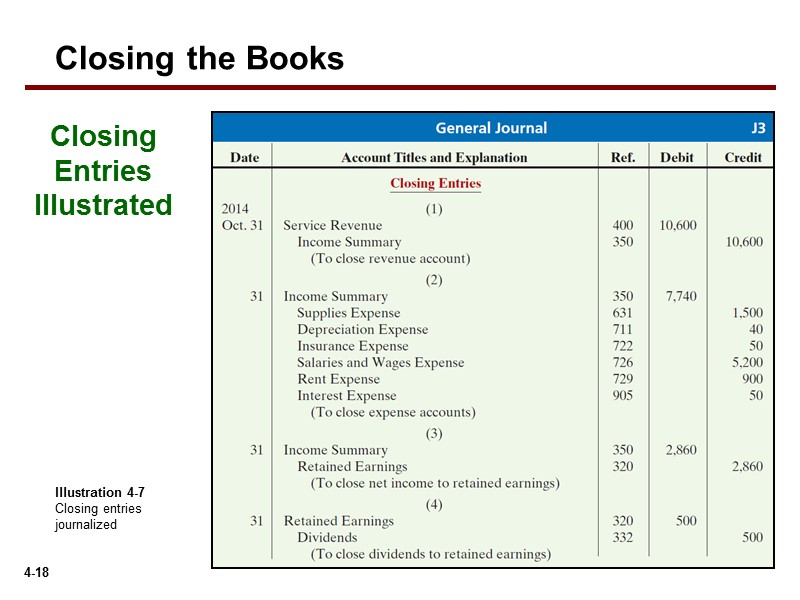

- Our discussion here begins with journalizing and posting the closing entries (Figure 5.2).

- It is a holding account for revenues and expenses before they are transferred to the retained earnings account.

- Closing entries help in the reconciliation of accounts which facilitates in controlling the overall financials of a firm.

Closing Entry in Accounting: Definition, Example, and Best Practices

Notice that the balances in interest revenue and service revenueare now zero and are ready to accumulate revenues in the nextperiod. The Income Summary account has a credit balance of $10,240(the revenue sum). Now, all the temporary accounts have their respective figures allocated, showcasing the revenue the bakery has generated, the expenses it has incurred, and the dividends declared throughout the past year. As mentioned, one way to make closing entries is by directly closing the temporary balances to the equity or retained earnings account. Accounts are considered “temporary” when they only accumulate transactions over one single accounting period. Temporary accounts are closed or zero-ed out so that their balances don’t get mixed up with those of the next year.

Now that we have closed the temporary accounts, let’s review what the post-closing ledger (T-accounts) looks like for Printing Plus. The retained earnings account balance has now increased to 8,000, and forms part of the trial balance after the closing journal entries have been made. This trial balance gives the opening balances for the next accounting period, and contains only balance sheet accounts including the new balance on the retained earnings account as shown below.

Then, credit the income summary account with the total revenue amount from all revenue accounts. Permanent accounts, also known as real accounts, do not require closing entries. Examples are cash, accounts receivable, accounts payable, and retained earnings. These accounts carry their ending balances into the next accounting period and are not reset to zero. All the temporary accounts, including revenue, expense, and dividends, have now been reset to zero.