You also get access to the MindBody Marketplace, where over 2.4 million users intersect. Additional features like the 24/7 AI chatbot and marketing automation make Mindbody a bookkeeping for hair stylist powerful all-in-one solution for beauty businesses. Learn how to leverage salon accounting software to make running your salon a breeze.

Learn Your Tax Filing Obligations

Quickbooks seamlessly syncs to North One business banking so you can track transactions and close your books, with ease. Customer support is https://www.bookstime.com/articles/bookkeeping-for-hair-stylist the most important thing about subscribing to any software solution for the company. As a business owner, you must ensure that customer service will always be available in any circumstances. More than that, it also improves the efficiency of company accounts payment procedures by using extremely sophisticated approval workflows.

What expenses can you claim as a childminder?

Aim to track finances monthly or bi-monthly, especially if your client base is large. Consistent updates make managing money much easier and less time-consuming. Wave Accounting is an excellent free software option for small-business proprietors. This cloud-based financial and accounting software is simple to use and engaging, even for people with little prior accounting knowledge, while being completely effective.

- Wave is a free accounting software that offers a range of features such as invoicing and payment processing.

- One key benefit of accurate accounting is that it allows you to identify areas where you can cut costs or increase revenue.

- Some features include a digital invoice, payment systems, and purchase orders.

- Think about it like monitoring traffic through your salon door – you want a steady stream coming in so everything runs smoothly inside.

- This feature is especially useful for salon owners who are always on the move.

How Much Will I Pay For Bookkeeping?

- Unless you’re an expert and you’ve enough time to handle both finances and attending to your clients, hire a bookkeeper.

- Your revenue is more than just haircuts and highlights; it’s also those chic little bottles of shampoo flying off the shelves and gift certificates bought by adoring clients.

- With several bookkeeping methods available, how do you know which one will be most suitable for your business?

- In cash accounting, expenses and revenue are only recorded after payment has occurred.

- For many hair stylists, especially those lacking an accounting background, maintaining proper bookkeeping can be daunting.

- Additionally, the software should be able to calculate payroll taxes and generate tax forms automatically.

- Each service is performed with the utmost care to ensure your hair looks and feels its best, with long-lasting results.

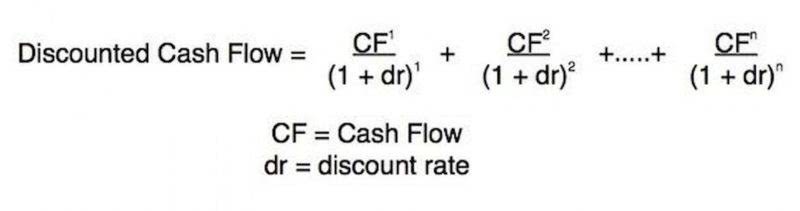

Choosing a bookkeeping method is crucial, with cash and accrual options available. Cash method records transactions after cash payments, while accrual method includes all transactions, enhancing financial transparency. Accrual method, though more complex, provides comprehensive financial insight.

Navigating Employee Tips and Taxes

There are new accounting methods and specific areas that are being developed. These need the use of versatile accounting software that can manage all of the complexity effectively and in real-time. To keep your finances in vogue, it’s vital to understand what expenses you can deduct. Salon-specific deductions might include the cost of shears, combs, chairs or even that fancy espresso machine that keeps your clients cozy while they wait. For more info on what qualifies as a deductible expense in your chic establishment, the IRS has got you covered. When it comes to running a salon, you might think that fancy hair products or those chic chairs bookkeeping are where most of your cash goes.

Neglecting bookkeeping can result in tax issues, financial mismanagement, and even business failure. By diligently maintaining financial records, self-employed hairdressers can secure their financial future, enhance profitability, and foster a stable and prosperous salon business. Furthermore, salon accounting software allows you to generate financial reports that give you a clear picture of your salon’s financial health. These reports can be customized to show you the information you need, such as revenue by service, expenses by category, and more. With this information at your fingertips, you can make informed decisions about your business and plan for the future. Before diving into the nitty-gritty of salon accounting, let’s begin with the basics.

Accounting Software for Salons Free Download

Thus, it assists you in streamlining your accounting procedures and lets you focus more on your core salon business. Ramco ERP is a basic budget program that provides cognitive ERP software for SMEs. This cloud-based accounting software for small businesses is hosted in the cloud and gives users a full-circle perspective on the company they are analyzing. Sage Accounting is an all-in-one salon and spa bookkeeping cloud solution.

The new Accounting Software from FreshBooks empowers salon owners like you to spend less time on bookkeeping and more time serving your clients. Gross margin measures the profitability of your salon’s revenue after deduction of direct costs of providing services or selling products. Gross Margin tells you the percentage of cash you have left from revenue earned after considering the direct costs of that revenue. It will help you determine the level of sales you need to meet your operating costs or hit desired profitability targets.