An Overview for CPA and Accounting Firms Outsourcing to India

In situations where urgent tasks or deadlines arise, firms can take advantage of the extra working hours in India. Bank reconciliation is a crucial step in bookkeeping to ensure accuracy and identify discrepancies between a company’s records and bank statements. Indian outsourcing companies have the capability to handle larger volumes of work and allocate resources accordingly. This flexibility enables firms to avoid the expenses and complexities of hiring and training in-house staff. Join us as we explore the multifaceted advantages of this trend, including cost savings, access to specialized talent, scalability, and enhanced productivity.

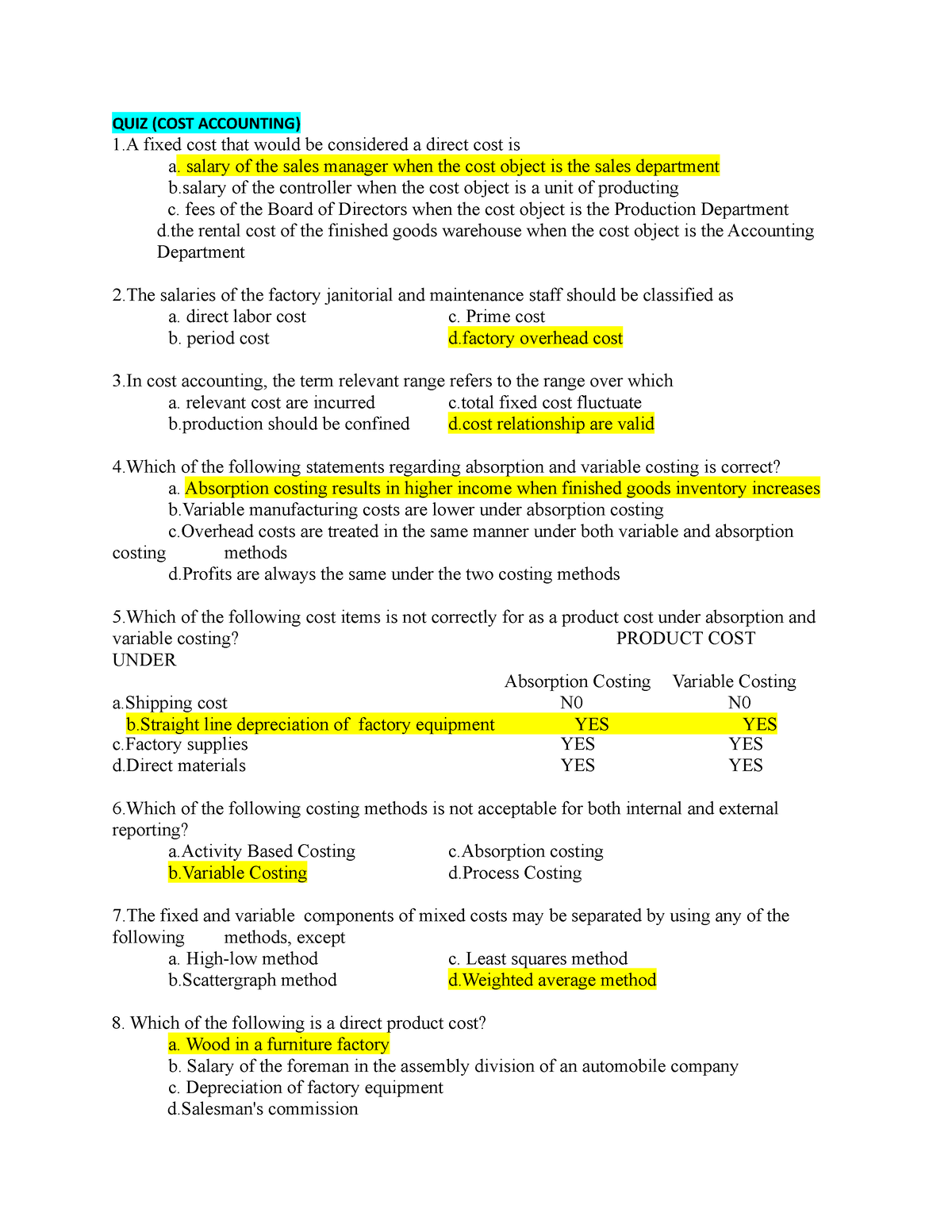

major benefits of accounts outsourcing to India

Indian outsourcing companies provide cost-effective solutions without compromising on quality. The lower labor costs in India the notion of accounts payable and the method of work with them and favorable exchange rates result in substantial savings for US firms. This financial advantage allows them to allocate resources strategically, invest in growth initiatives, and improve overall profitability. By outsourcing accounting and bookkeeping tasks to India, US CPAs and accounting firms can focus on their core competencies. They can allocate more time and resources to strategic activities such as financial planning, advisory services, and client relationship management.

Welcome to Indian Book Keeper

Indian bookkeeping service providers have high-level security systems in place with restricted access to authorized staff. As a result, accounting firms in India are equipped with the latest accounting software, internet services, and security solutions. This enables them to cater to all of your accounting needs quickly and accurately, making it a great destination for accounts outsourcing.

- By entrusting your bookkeeping to Bill Accounting, you benefit from accuracy, timely reports, and the peace of mind that comes from knowing your financial transactions are managed by experts.

- With a time difference of approximately 9-12 hours, firms can send their work at the end of their day and receive completed tasks the following morning.

- By outsourcing their accounting and bookkeeping functions, CPA firms can save significant money and time while gaining access to specialized expertise and cutting-edge technology.

- You will be assigned a dedicated account manager who will serve as your primary point of contact.

- India has a strong cultural compatibility with the USA, making collaboration between US CPAs and accounting firms and their Indian outsourcing partners smooth and effective.

CapActix is an ISO-certified accounting outsourcing company, dealing with specialized solutions in the finance industry. Based in Ahmedabad, India, with offices how to do a bank reconciliation in the US, the Philippines, and East Africa, the company has clients all over the world. When you outsource your accounts to India, you’re essentially handing over the accounting department to a different team in a separate time zone.

The top 5 virtual assistant companies in the USA

Indian CPA firms also have a deep understanding of the finance sector and can provide high-quality services at a lower cost. Outsourcing bookkeeping services to India offers numerous advantages for CPA and accounting firms. To ensure the protection of sensitive financial information, it is crucial for CPA and accounting firms to have discussions with outsourcing bookkeeping companies in India regarding security measures. Recognizing that every business has unique requirements, we offer custom solutions designed to meet your specific accounting challenges.

What are the benefits of outsourcing and specifically, use of the firm’s BMC SaAS division?

Book a call today to uncover how outsourcing accounting and bookkeeping services can transform your accounting firm. With this scalability advantage, firms can focus on their core activities while still maintaining cost-effectiveness and efficient service delivery. To ensure a successful partnership, choose a bookkeeping service provider in India with positive client feedback, demonstrating their trustworthiness and ability to meet your specific requirements. Being at the forefront of technological innovation, Indian outsourcing providers leverage cutting-edge software tools to deliver superior service. These platforms encapsulate the latest advancements in financial technology, seamlessly integrating with business operations to streamline bookkeeping processes. Foreign companies can outsource to Indian CPA firms (Certified Public Accountants) to benefit from their cost-effective and quality services.

Connect with us today, and together, let’s build a robust financial future for your business. India is a developing country, so it has a lower cost of living present value of a single amount and labor charges compared to most other developed nations.

In this section, we will discuss some key steps that CPA and accounting firms can take to find trustworthy and competent bookkeeping services in India. From researching and comparing companies to discussing security measures, we will cover everything you need to know before outsourcing your bookkeeping needs. With the rise of globalization and outsourcing, many CPA and accounting firms are turning to India for their bookkeeping needs. While this can be a cost-effective and efficient solution, it is important to ensure that the chosen bookkeeping services are reliable and of high quality. Outsourcing bookkeeping services in India offers CPA and accounting firms several benefits, including efficient financial reporting.

.png)

.jpeg)